Working Families Tax Credit

What is the WFTC?

The new Working Families Tax Credit (WFTC) will provide $1,200 cash back into the pockets of Washington workers trying to make ends meet. Beginning in February 2023 individuals with and without children and people that file their taxes with a Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN) will be able to claim this money.

Okanogan County Community Action Council (OCCAC) received a grant from the Washington State Department of Commerce to get the word out about the tax credit and support qualifying Okanogan residents in applying for the benefit when filing their federal income tax. Tax credits for working low-income individuals and families will help tremendously with today’s higher costs for basics like food, rent, heat, and fuel. We are working to set up a network of tax accountants in Okanogan County whom we will contract with to support residents with their tax filings and applications for the tax credit.

Who is Eligible?

- Applications open February 1, 2023 for the 2022 tax year and are accepted through December 31, 2023. Individuals and families are eligible for the WFTC if they meet all of the following requirements:

- Have a valid Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Lived in Washington a minimum of 183 days in 2022 (over half the year). See the Department of Revenue’s (DOR) Frequently Asked Questions (FAQs) about residency to learn more.

- Are at least 25 and under 65 years of age OR have a qualifying child in 2022.

- Filed a 2022 federal tax return.

- Eligible to claim the federal Earned Income Tax Credit (EITC) on their 2022 tax return (or would meet the requirements for EITC but are filing with an ITIN). Go to www.irs.gov/EITC to learn more.

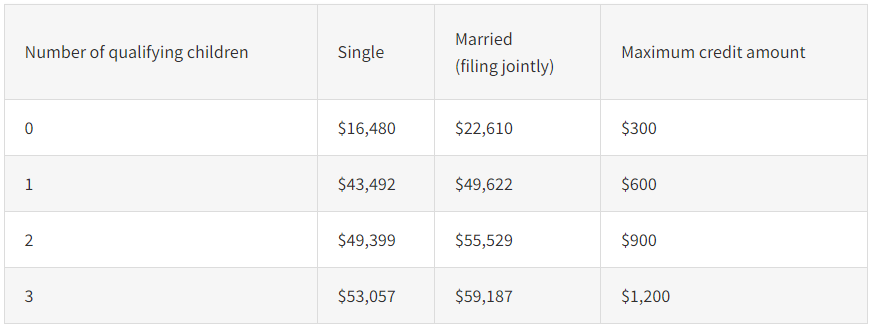

- The credit amount varies depending on the number of qualifying children and income level.

Ways to Apply

You can apply for the Working Families Tax Credit (WFTC) using one of these three options listed below.

Video: How to Apply (1:45)

Video: Applying with an ITIN (3:11)

What you’ll need to apply

To apply for the Working Families Tax Credit, you will need the following:

- A copy of your federal tax return that you filed with the IRS.

- Your Social Security Number or ITIN, and dates of birth for you, your spouse, and children.

- Your Washington state driver’s license or ID number (if you have one).

- Your residential and mailing address.

- Your bank routing number and account number if you choose direct deposit.

Video: What you’ll need to apply (0:29)

Contact Information:

Contact the Washington State Department of Revenue with questions at http://workingfamiliescredit.wa.gov/contact-us or via phone at (360) 763-7300

Financial Literacy Courses

As part of the grant, OCCAC will be offering Financial Literacy courses through LinkedIn. The Financial Literacy program aims to enlist 50 OCCAC clients to attend either online or in-person classes to learn how to improve or maintain their current financial status, inform individuals/families of the availability of the WFTC and Earned Income Tax Credit (EITC) benefits or if needed Individual Taxpayer Identification Number (ITIN) application assistance.

How does it work?

If you are interested in learning about Financial Literacy, you can call our office at (509) 422-4041. A LinkedIn profile will be made available for you at no cost. After receiving your login information, the Financial Literacy courses will show up on your LinkedIn profile as “Build your Financial Literacy course,” and will be available on your profile forever.

If you are NOT interested in the Financial Literacy courses but want to know more about the Working Families Tax Credit, call our agency at (509) 422-4041. You will be directed to someone who will connect you to a local certified public accountant (CPA) who will help you to file your taxes with the new tax credit.